The following features highlight the three foremost types of immunity present in humans. The types are 1. Innate (Natural or Nonspecific) Immunity 2. Received (Specific or Adaptive) Immunity 3. Active and Inactive Immunity.

Table of Contents

Type # 1. Innate (Natural or Nonspecific) Safety:

Innate immunity (also described nonspecific or natural immunity) applies to the inborn-ability of the body to resist and is genetically transmitted from one generation to the next. This immunity extends resistance to any microorganism or foreign material encountered by the host.

It includes general tools inherited as part of the innate structure and function of each vertebrate and turns as the first line of defense. Natural immunity lacks immunological memory, i.e., it occurs to the identical extent specific time a microorganism or foreign material is encountered.

Types of Innate Immunity:

Innate immunity can be separated into species, racial, and individual immunity.

(i) Species Immunity:

Species immunity (species resistance) is that in which a condition afflicting one species does not affect the other species. For convenience, humans do not catch cattle plague, chicken cholera, hog cholera, infectious horse anemia, etc., while animals are not attacked by many human diseases such as enteric fever, syphilis, gonorrhea, scarlet fever, measles, etc.

Conditions of the skin, to which humans are pretty susceptible, are often obtained by animals because they have more hair and thicker hides. Species resistance is thought to be the result of a long evolution of interactions between the extremely evolved “macro” organisms and the pathogenic microorganisms.

(ii) Racial Immunity:

Racial immunity (ethnic resistance) is that in which different races (breeds) show marked differences in their opposition to particular infectious diseases. A well-known example is that Brahman cattle are resistant to the protozoan parasite responsible for tick fever in other breeds of cattle.

Similarly, few people affected by sickle cell anemia, a genetic disorder, are resistant to malaria, while malaria attacks other human races.

(iii) Individual Immunity:

Having the identical racial background and opportunity for exposure, some people of the race experience fewer or less difficult infections than other people of the same race.

For convenience, children are more susceptible to infections such as measles and chicken pox, while aged people are susceptible to other infections like pneumonia. You can opt Family Medicine.

Type # 2. Acquired (Specific or Adaptive) Immunity:

Obtained immunity (also called special or adaptive immunity) refers to immunity that is revealed by the proprietor in its body after the presentation to a suitable antigen or after the transfer of antibodies or lymphocytes from an immune contributor.

Characteristics of Acquired Immunity:

Acquired immunity is extraordinarily adaptive and is able to explicitly identifying and selectively eliminating foreign microorganisms and macromolecules, i.e., antigens.

It presents the following four characteristic features that differentiate it from nonspecific (innate) immunity:

(i) Specificity:

According to the Immunology Journal, acquired immunity is greatly antigenic specific as it acts against a particular microbial pathogen or foreign macromolecule and protection to this antigen normally do not confer resistance to others. For convenience, the capacity of the antibodies to differentiate between antigen molecules changes even by a particular amino acid.

What To Know More About Immunology?

Have you ever had a cold? Did you know that the standard symptoms are truly part of your immune system working to attack off germs? The sneezing and runny nose support physically push germs out of the body, and the fever can eliminate germs that can’t examine the heat.

In addition, you have groups throughout your body that are specifically trained to hunt down and kill special viruses and bacteria.

The study of the body’s defenses is called immunology. The immune system is typically associated with protecting against foreign intruders, called pathogens, but it can fight against cancer as well.

Immunologists can study fundamental immunology, which asks simply how the immune system does its job. They can also study clinical immunology, which looks at how disorders of the immune system can cause disease, but also how we can work with it to happily do transplants and make vaccines to limit disease.

Let’s take a solid look at both of these fields. In immunology journal it is mentioned that immunology problem can also be treated and cured with Family Medicine.

Basic Immunology

- Basic Immunology Journal is a part of immunology that looks at what generally occurs in the immune system. For example, what functions do different characters of immune cells and chemicals have? How do they react to another functions?

- Some essential immunologists focus their on the innate immune system, which protects against all potential intruders. That is, the components of the native immune system are not picky about what they attack.

- Immunologists can study how different characters of cells behave and contribute to immunology. For instance, neutrophils are a type of white blood cell that are part of the natural immune system.

- The adaptive immune system, on the another hand, targets particular pathogens. Scientists can study how a variety of cell learns to identify a particular pathogen, and what functions that cell has.

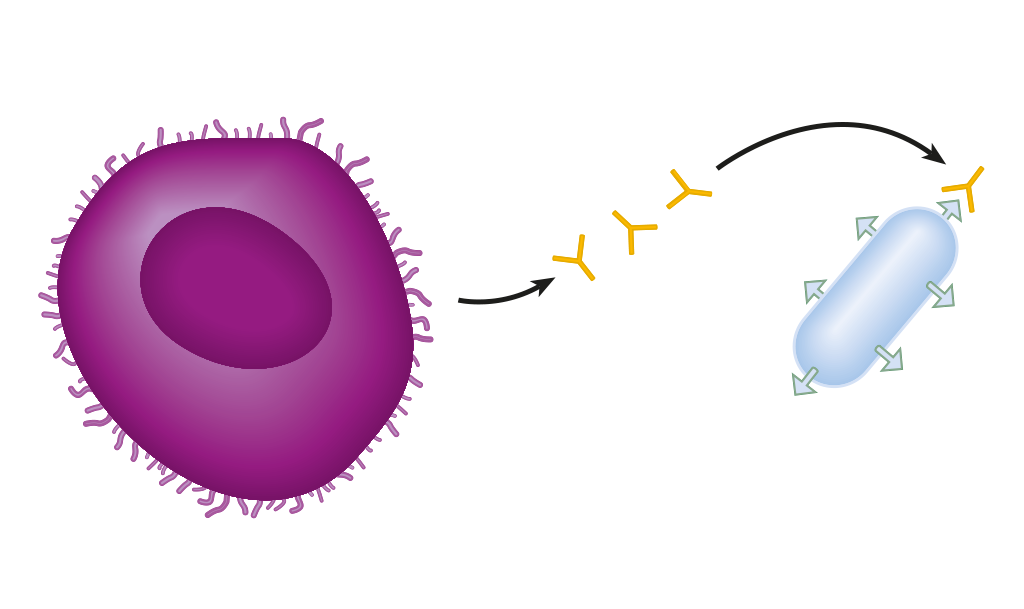

B cells are a component of the adaptive immune system that produce proteins called antibodies. When an antibody first recognizes a germ, it generates the B cell to copy itself and produce more antibodies. The next time it detects that pathogen, it can react more quickly and efficiently. Immunologists might suggest how the B cell is able to adjust the amount and type of antibody it produces throughout an infection.

Clinical Immunology

- Clinical immunology looks at how the immune system can fail and actually cause disease, as well as how we can work with it to prevent infection.

- Autoimmunity and Allergies

- What results when the immune system fails in some way? For example, if the immune system attacks a person’s own body, the result is an autoimmune condition. Clinical immunologists are trying to figure out what triggers autoimmune disorders, and how they can be treated.